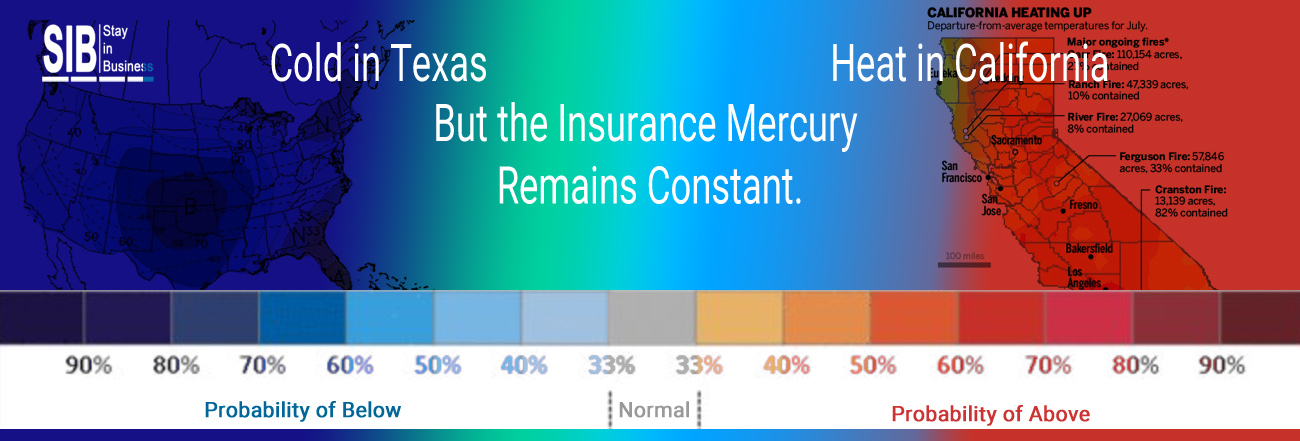

Heat in California. Cold in Texas. But the Insurance Mercury Remains Constant.

Insurance companies’ reluctance to pick the tab for the February snow storms in Texas draw close parallels with their approach to the Californian wildfires. The insurers’ stance is that the power suppliers should have been better prepared.

The allegation could not be easily scoffed at given that the damages incurred in many places such as East Austin were in excess of $10 billion.

Heavy snowfall in February disrupted many power supply facilities leaving countless homes water logged and in a complete blackout. Losses were in the range of billions of dollars. Insurance companies have plenty of reason to believe the power companies ought to pay for the damages.

A couple of months down the line, the insurers are putting together a legal case to prove that the disaster was manmade and that the power utility companies must bear the expenses for being unprepared for the impact of cold weather.

One of the lawyers representing the insurers commented that the insurance fraternity is rigorously researching the operational procedures at the Texas power grid to identify flaws that led to the hazard.

This approach is very similar to their response after the wildfires that broke out in California in 2017 and 2018. Faulty infrastructure at the Pacific Gas & Electric ignited flames that set entire settlements on fire. Now the insurers and their commercial associates have to bear the expense of more than $10 billion worth of insurance claims which will oblige them to raise the insurance premium for property owners.

But this approach can pose far more challenges in Texas where a lack of stringent government norms over many decades have led to the proliferation of numerous and mutually interdependent power companies which makes identifying the root cause a lot more difficult. And unlike in California, the insurance companies in Texas will have to show evidence that “gross negligence” led to the power outage.

Insurance companies are of the opinion that the power companies were unprepared despite similar snow storms in the past and environmental data that clearly identified the threat. The impact of extreme cold conditions has been destructive enough for state and federal authorities to make strong recommendations in 1989 and 2011 to fortify the existing power infrastructure against inclement weather based on extensive research that identified issues in the system.

One of the insurers’ Dallas based attorneys said that in 1989 and even before, the systems’ shortcomings to deal with cold weather was known to all and yet, no remedial action was taken. Texan power companies exercise oligarchic control over the supply of electricity in the state and were expected to ensure that access to the utility was constant and uninterrupted.

The Dallas attorney further stated that the basis for litigating against these power companies was that despite a sizeable market share, they failed to provide free-flowing electricity to their customers.

The insurance claims’ paperwork would take months. But the insurers’ lawyers are undeterred and are busy putting together a formidable case with hard evidence. After receiving the claims, the insurers would have to send an official notice within a month to the power suppliers of their intended course of action. This task is already underway and numerous power companies have received written notifications. Nevertheless, the Dallas based attorney refrained from disclosing the names of the insurance companies on whose behalf this case was being litigated.

Despite widespread speculation in the public domain over the case’s development, many of the state’s major insurance firms were taciturn about the likelihood that they might follow this course of action against the power companies. However, a spokeswoman for the Insurance Council of Texas (ICT) came forward to categorically criticize the power companies for the extensive damage to property their customers had to bear. Recovering these monetary losses from the power companies would allow the insurance firms to compensate either a portion or the full amount of their customers’ deductibles.

But holding these Texan utility companies responsible for the damage to property proves to be a lot more difficult than in California where it is easier to map a disaster’s cause to a fault in a specific large corporation’s power grid.

The Texas power utility landscape consists of multiple power companies, relatively small-sized when compared to their Californian counterparts. Unlike in California, there are numerous interdependencies between these Texan power companies. The flow of energy begins at the natural gas drilling site. The fossil energy is transported across a network of pipeline operators, generating stations, power transmission facilities and other intermediate units. An outage at one of these facilities interrupted the flow of energy to all the facility’s interconnected units which, as a result, also suffered an outage.

The external communications team at Oncor, the largest power corporation in Texas, wasn’t available for comment regarding the insurance companies’ claims. However, one of their spokeswomen remarked that power companies such as Oncor couldn’t be blamed entirely for the fault since they are only responsible for power transmission and distribution. She also remarked that Oncor and similar companies are largely dependent on other corporations for principal processes such as power generation, customer billing and so on.

CenterPoint, Houston’s principal power provider, expressed great inclination towards cooperating with the government and other official bodies to curb the impact of such environmental disasters. However, due to the ongoing litigation, they refrained from making public their views on the insurance companies’ claims. Other power companies such as Luminant and Entergy Texas were similarly mute on the subject.

A major challenge for the insurance companies is to overcome the liability standards in Texas that strongly favor the power corporations, unlike in California. This was the case even prior to a court order in Texas that provided additional legal protection to the state’s largest power corporation, making it all the more difficult to penalize them.

Earlier, the legal system in California allowed insurance companies to litigate against power companies whose technical negligence caused a fire outbreak, even without evidence. In Texas, however, evidence is mandatory in such cases. The month of March witnessed the Texas Supreme Court exempt the Electric Reliability Council of Texas (ERCOT) from all prosecution against them pertaining to winter storms over the last two months. The court order absolved ERCOT of all blame on the grounds that they provided citizens with a utility of prime importance, almost to the extent of a government body.

ERCOT’s legal insurance provider however aren’t leaving any loose ends. The Cincinnati Insurance Company recently commenced a federal court proceeding to defend their right to not represent ERCOT in court cases where the power company is being sued to pay for property damages. Cincinnati said that ERCOT’s liability insurance policy with them only covered accidental damage. The power cuts in February however were forecasted, anticipated and/or deliberate.

Estimates regarding the damages the storm caused vastly differ but are unanimously significant. One such estimate based on catastrophe modelling approximated the insured losses at nearly $20 billion across 20 states. A sizeable portion of these losses were from Texas which has been working in silos for years. So unaffected power suppliers in neighboring states could not assist Texan facilities in seamlessly transitioning power disruptions.

The losses were extensive enough that they had to bring in self-employed claims adjusters merely to manage all the surge in claims being sent in.

It was nearly impossible to contact the insurance companies, given the high volume of claims being processed. Many contractual workers even changed professions after the storm to meet the sudden rise in disaster time requirements such as emergency plumbing. One such emergency plumber, in an act of solidarity, didn’t even insist on an upfront payment. Although his customers would have later offset these payments with their insurance checks, many of them had lost their jobs during the pandemic. So he told them to just pay him when they had the money. He even did a plumbing job worth nearly $15,000 for an elderly lady who had no water for nearly two weeks. He then followed up with her insurance company regarding her late payments.

Even if the power companies pay for the losses caused by the cold storms, there is still no clarity over the precautionary steps they plan on implementing to avert such hazards in the future. Recent studies in Houston show that around fifty percent of all citizens were against making power facilities winter resistant if it made power more expensive.

Categories: Disaster Recovery Planning, Insurance, Natural Disasters, Supply Chain